ri tax rate income

Each tax bracket corresponds to an income range. DO NOT use to figure your Rhode Island tax.

Pin By Sherry Szczepanski On Misc Info Understanding Parenting Relationship

Your 2021 Tax Bracket To See Whats Been Adjusted.

. Find and Complete Any Required Tax Forms here. To calculate the Rhode Island taxable income the statute starts with Federal taxable income. Census Bureau Number of cities that have local income taxes.

A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate. The table below shows the. Residents and nonresidents including resident and.

Rhode Island Income Tax Rate 2022 - 2023. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. Rhode Island Tax Table.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. DO NOT use to figure your Rhode Island tax. DO NOT use to figure your Rhode Island tax.

The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Any income over 150550 would be.

Rhode Island also has a 700 percent corporate income tax rate. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Rhode Island Income Taxes.

For more information about the income tax in these states visit the Massachusetts and Rhode Island income tax pages. Rhode Island has a. Discover Helpful Information And Resources On Taxes From AARP.

Ad Compare Your 2022 Tax Bracket vs. Rhode Island Tax Table. For income taxes in all fifty states see the income tax by state.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Compare your take home after tax and estimate.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Now that were done with federal income taxes lets tackle Rhode Island state taxes. Rhode Island income tax rate.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

The state has a progressive income tax broken down into three tax brackets meaning. How Your Rhode Island Paycheck. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of.

Rhode Island Tax Brackets for Tax Year 2021. Your average tax rate is 1198 and your. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Instead if your taxable income. The range where your annual income. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator.

Rhode Island Income Tax Calculator 2021. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. Ad Get Ready for Tax Season Deadlines.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Islands 2022 income tax ranges from 375 to 599.

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Best Places To Move

Taxprof Blog In 2022 Infographic Map Real Estate Infographic Map

Map Shows The Income Needed To Afford The Average Home In Every State In 2022 Income States Current Mortgage Rates

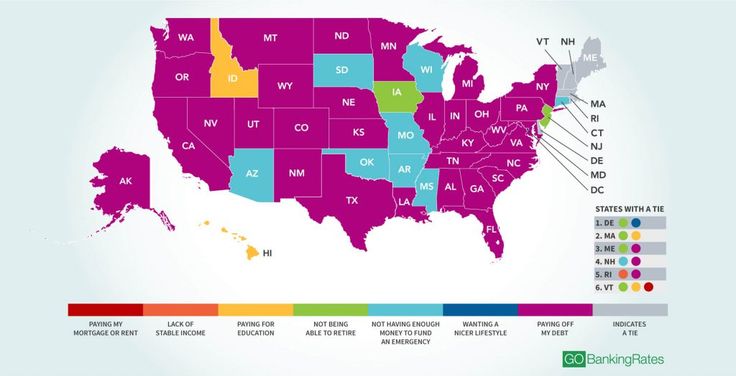

The No 1 Cause Of Financial Stress In Every State

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest Rates

Military Retirees Retirement Retired Military Military Retirement

Tax 1040 Form With Money And Calculator Sponsored Paid Ad Tax Form Money Calculator Tax Tax Forms Money

Mandatory Mortgage Documents Preapproved Mortgage Mortgage Mortgage Tips

State By State Guide To Taxes On Retirees Sales Tax Tax Payroll Taxes

Pin On 1 000 Ways To Look At Data

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

State By State Guide To Taxes On Retirees Kiplinger

Where Your State Gets Its Money Charts And Graphs Data Visualization Design Data Visualization

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

Taxes Account For A Large Part Of Cellular Phone Bills Capital Gains Tax Tax Pensions

State By State Guide To Taxes On Retirees

Which U S States Have The Lowest Income Taxes Income Tax Income Pinterest For Business